Quality study material significantly influences examination success rates and learning efficiency across competitive banking examinations. Generic notes often lack structure, accuracy verification, and comprehensive coverage that serious candidates require for thorough preparation. Random compilation of information creates confusion rather than clarity, leading to knowledge gaps and ineffective revision cycles that waste precious preparation time.

Professional study resources undergo rigorous quality checks, expert validation, and systematic organization to ensure maximum learning impact. Structured materials follow logical progression patterns while focusing on examination requirements and current industry trends. A well-designed financial awareness pdf incorporates multiple learning elements, including visual aids, practice questions, and cross-references that enhance retention and understanding. Let’s explore what approach distinguishes professional resources from hastily compiled notes that often mislead candidates and compromise preparation quality.

Structural Organization and Logical Flow

Professional financial awareness materials follow predetermined organizational frameworks, facilitating systematic learning and easy navigation. Topic sequencing follows complexity gradation, starting with fundamental concepts before advancing to intricate financial mechanisms and regulatory frameworks.

Clear chapter divisions, subsections, and indexing systems enable quick reference and targeted study sessions during revision periods. Random notes typically lack coherent structure, jumping between topics without establishing conceptual connections or prerequisite knowledge requirements.

Content Accuracy and Expert Validation

Accuracy verification distinguishes professional study materials from unreliable sources, potentially spreading misinformation among candidates. Expert subject matter specialists review content for factual correctness, regulatory compliance, and current industry relevance before publication.

Regular updates ensure information remains current with changing financial regulations, policy modifications, and market developments that affect examination syllabi. Professional materials undergo multiple review cycles, fact-checking procedures, and peer validation processes that ensure reliability. Citing authentic sources, official documents, and expert acknowledgement enhances credibility and builds trust among serious exam candidates.

Examination Alignment and Syllabus Coverage

Strategic syllabus mapping ensures comprehensive coverage of examination requirements without unnecessary content that dilutes focus and wastes study time. Professional materials analyze previous question papers, identify recurring themes, and emphasize high-weightage topics consistently appearing across examination cycles.

Difficulty level calibration matches examination standards while providing appropriate depth for thorough understanding. Random notes often miss crucial topics while overemphasizing less critical areas, creating unbalanced preparation that leaves knowledge gaps.

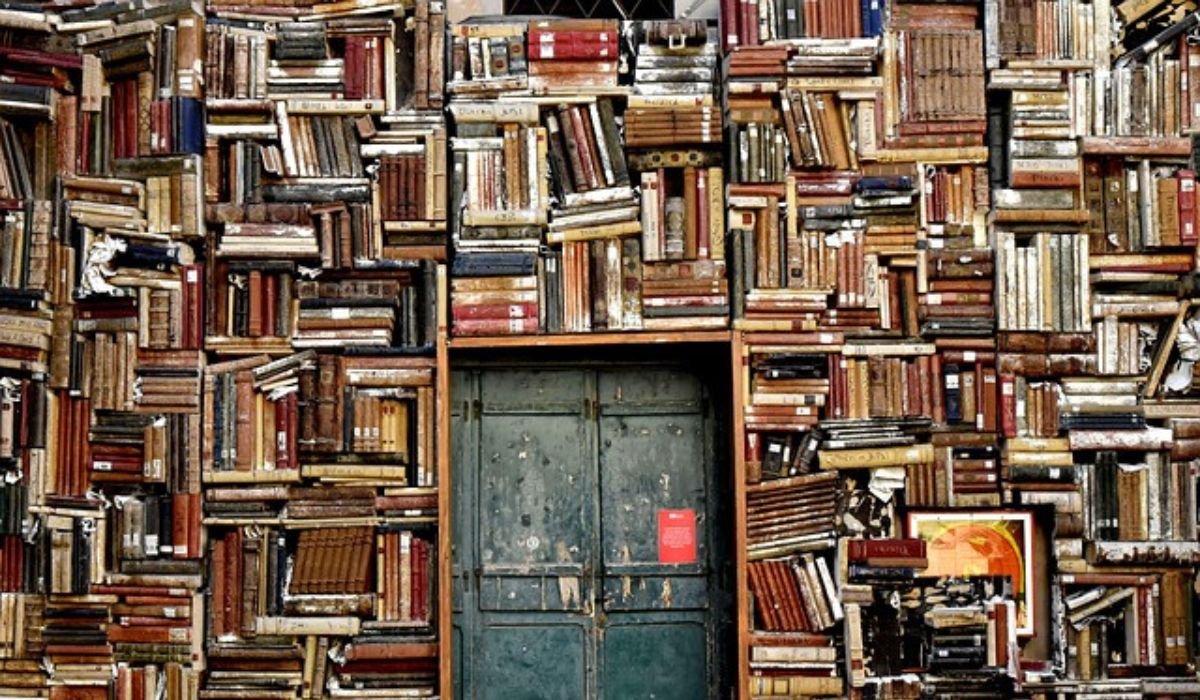

Visual Design and Learning Psychology

Effective layout design incorporates learning psychology principles that enhance information retention and reduce cognitive load during study sessions. Strategic use of colours, fonts, spacing, and visual hierarchy guides attention toward important concepts while maintaining reader engagement.

Professional typography standards improve readability and reduce eye strain during extended study periods. Amateur compilations often ignore design principles, resulting in cluttered layouts that hinder learning effectiveness and create visual fatigue.

Updates and Currency Maintenance

Financial sector dynamics require continuous content updates to reflect regulatory changes, policy modifications, and market developments affecting examination relevance. Professional publishers maintain dedicated teams to monitor industry changes and implement timely updates across study materials.

Version control systems ensure candidates access the latest information while maintaining historical context where necessary. Professional materials include update schedules, revision notifications, and supplementary content releases that inform candidates about relevant changes.

Long-term Value and Reusability

Well-structured financial awareness materials provide lasting value beyond immediate examination preparation, serving as reference resources throughout banking careers. Comprehensive coverage, logical organization, and expert insights make professional materials valuable for continuous learning and skill development.

Investment in quality resources pays dividends through improved examination performance and enhanced professional knowledge base. Financial awareness pdf resources that combine examination focus with career relevance provide superior value propositions to temporary note compilations that serve limited purposes.

A good financial awareness PDF stands out through its structured content, expert validation, and alignment with exam requirements. Unlike random notes, it offers accuracy, clarity, and a focused approach tailored to banking exams. Its professional design and regular updates ensure relevance and long-term usability. Investing in such high-quality material improves exam readiness and builds a strong foundation for a successful banking career.

YOU MAY ALSO LIKE: On RarefiedTech.com Fintech: How Financial Innovation is Democratizing Access and Redefining Security